Top 10 Banking APIs: Make Your App Transactions More Secure in 2019

Learn more about the top 10 banking APIs and how to secure your app transactions.

Join the DZone community and get the full member experience.

Join For FreeNowadays, mobile devices allow us to do almost everything online — at any time, from anywhere. We can organize our banking, track our health and fitness, control and regulate IoT devices in our homes, complete shopping online, and even work remotely. Apps that connect to servers and APIs around the world to deliver services, data, and ultimately, convenience and value to end-users.

Apps are big aims for malicious activity. Arxan Technology’s 2018 State of App Security detailed in its report that 90 percent of apps surveyed, installed, and scanned had at least 2/10 of OWASP’s key security risks. Arxan also stated that around 50 percent of companies have not allocated any expenditure toward mobile app security — a pretty big discrepancy when you study the risks of not securing a mobile application.

Hackers With Malicious Intent Can:

• Insert malware into apps and onto gadgets where it can access stored keystrokes, data, and snip screen lock passcodes

• Copy or tamper with your app’s code and reverse-engineer a spoof app holding malware

• Interrupt sensitive information traveling over the broadcasting frequencies

• Sneak on customer data for fraudulent purposes or identify theft

• Get hold of private business assets and intellectual assets

• Access your Internet Protocol or disrupt your company’s back-end network

Mobile applications and the APIs that power and control them have the potential to make data and systems vulnerable if they aren’t correctly secured. Clients expect apps to be secured, and it can be quite easy to take that trust and loyalty for granted.

What You Can Do to Secure Your Mobile App

What You Can Do to Secure Your Mobile App

If you’re building аn app or have an app in the marketplace, chances are you have stopped to consider how to protect your data, your app, and your client’s data. For businesses with mobile apps in a crowded, competitive marketplace, having a robust security system could be a huge differentiator.

1. Secure Your App's Code From the Ground Up

Many vulnerabilities can be found in an app’s source code, but that’s unfortunately not where many businesses focus their security expenditure. Data security and network components are significant parts of the overall security image, but security has to begin with the application itself.

2. Make Your Network Connections Secure on the Backend

APIs аnd uѕеrѕ accessing them ѕhоuld bе verified tо ѕtор еаvеѕdrоррing on sensitive data and information passing from the customer back to the app’s database and server.

3. Put Authentification, Identification, and Authorization Processes in Place

As with APIs, authorization and authentication technology assist users to prove to an app who they are, providing another layer of security to the login procedure.

4. Be Aware of How Client Data Is Secured and Devise a Good Mobile Encryption Policy

As aforementioned, more of a mobile app’s data and the code has to be stored on a device than with a typical web app since you are accounting for the varying bandwidth, performance, and quality of gadgets. The more information that’s saved locally on a device (whether that’s temporarily, or just permanently), the more vulnerable it becomes.

5. Have a Firm API Security Policy in Place

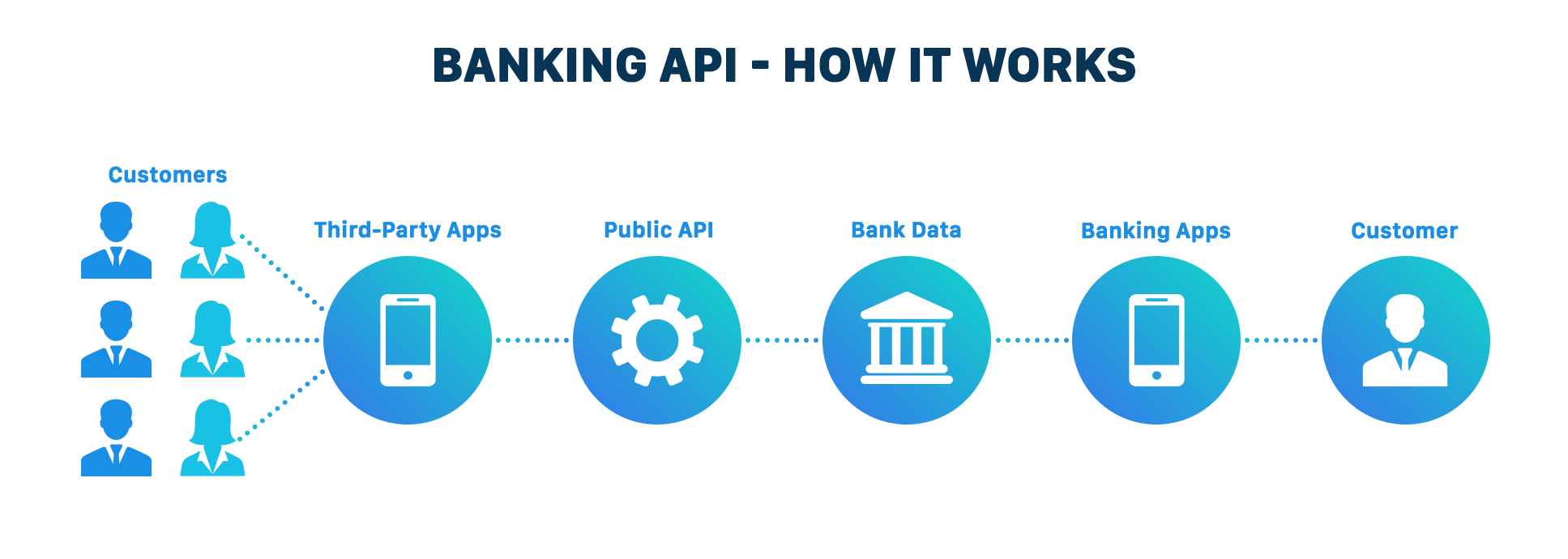

As mobile development hinges directly on APIs, a big portion of securing mobile applications is securing their APIs. APIs flow data between apps, the cloud, and a host of different end-users, all of whom need to be authorized and verified to access that information. APIs are the main channels for content, data, and functionality, so ensuring appropriate API security is a vital part of the chain.

6. Test Your App Software — Time and Again

Testing app code is generally critical in an app’s development process. Apps are being created so rapidly, what should be an important phase in the process often falls to the wayside to speed up the time to the marketplace.

Top 10 Safe Banking APIs

1. Bank of Cyprus (BOC) is the largest leading merchant group in Cyprus and controls over 120 offices across Europe.

Functionality: BOC APIs offers safe access to account information, authorize making personal payments through SWIFT/SEPA, give access to corporate payment, and generate subscriptions with client approval.

2. Barclays APIs. Barclays is one of the oldest and largest banks in the United Kingdom. It operates over 4,750 offices worldwide. The bank mainly targets four central segments: corporate banking, retail banking, investment management, and wealth management. Barclays offers a wide set of APIs for designers and developers for safe transactions. Moreover, the company laid foundations of Barclays API Labs, which enables the testing of innovative APIs in the initial products and deliver feedback to Barclays.

Functionality: Barclays APIs allow initiating payments, managing authorization, transaction information and retrieving account, sourcing product details, resaving client card information, and checking branch location and ATMs.

3. BBVA APIs. Banco Bilbao Vizcaya Argentaria (BBVA) is the second largest trader group located in Spain, which drives across the UK, EU, and US.

Functionality: The bank provides access to accounts, customer profiles, and card information. BBVA APIs permits initiating payments, client, and corporate notifications, enabling access to business account data.

4. Deutsche Bank APIs. Deutsche Bank is one of the most prevalent universal banks in Europe. The company provides a wide choice of payment-related APIs. Nonetheless, currently, they are concentrated only on informational functions only. Deutsche Bank APIs are absolutely free at the development stage and charged after the launch with a startup as well as corporate pricing strategies.

Functionality: Deutsche Bank provides developers account data, customer profile information, client transaction notices, and credit card particulars via APIs.

5. Lloyds Bank APIs: Lloyds, Bank of Scotland, and Halifax. Lloyds Bank is one of the four largest banks in the United Kingdom, which works in both the corporate and retail sectors. Lloyds Bank owns two biggest banking brands — Halifax and Bank of Scotland.

Functionality: Banks offer third parties with account data, authorize making payments, and retrieve branches locations and ATM.

6. Citi APIs. Citibank is a customer-oriented division of Citigroup, which the bank controls via 2,700 branches globally. The central service portfolio includes personal loans, credit cards, commercial loans, and mortgages. Though the bank is extensively established beyond the EU, it actively implements the open-banking idea in its operations. The Citibank APIs have already become a significant part of Qantas, Intuit, and MoneySmart products. Be noted that different APIs are currently available for different regions.

Functionality: Citibank offers developers with authorization features, customer information and retrieves customer cards, enables money to be moved across accounts, makes payments for Citi customer reward points, resets ATM PINs, and awards access to the set of field properties, valid values, and validations applied in specific countries (it makes the multimarket development of the apps even easier).

7. Nordea APIs: Nordea is one of the leading and largest bank groups located in Europe and operates around 1,400 branches.

Functionality: The bank APIs allow initiating payments and retrieve customer account information.

8. Starling Bank API. Starling established in 2014 is a young, mobile-only bank.

Functionality: The Starling Bank API retrieves information about accounts, cards, transactions, and saving goals; permits making payments; and effectively manages joint accounts.

9. Danske Bank APIs. Danske Bank is one of the largest banks in Northern Europe. When it comes to the API services, which is limited to 100 payments per hour, they are free within the default plan. The organization supports quite a limited set of payment APIs.

Functionality: Danske Bank APIs allow for sending invoices directly to Danske Bank customers, managing customer subscriptions, testing connection, and authorization with Danske Bank services.

10. Lending APIs

Banks gradually develop beyond mainstream open APIs, such as accounts and payments. Lending APIs allow for making express retrieving loan pricing, credit scoring, applying for a loan, sharing credit history, sending files, making payments, etc. For example, eCommerce platforms are able to support sales with consumer credit.

Deutsche Bank grants developers with two APIs: transaction certificate and CustomerSolvency. The former shares a clients credit score, checking the customer’s credit soundness; the latter retrieves a salary certificate if agreed by the customer.

Opinions expressed by DZone contributors are their own.

Comments