What Is BaaS and How It Can Help Fintech Startups?

BaaS platforms can help fintech startups achieve the fastest time-to-market and save a lot of time and resources on the implementation of financial services.

Join the DZone community and get the full member experience.

Join For FreeFintech applications are pretty tricky and expensive to build. Regulations, liquidity, and banking system integrations add an extra layer of complexity on top of the technical aspect. Starting a new PayPal or Revolut-like app requires having a business, legal, financial, and technical team.

My research of the potential shortcuts for fintech applications indicated that building everything from scratch is unnecessary. The market provides a range of ready-made Banking as a Service (BaaS) platforms. First, let’s find out what BaaS is and how those solutions can help fintech startups get on their feet at the quickest time to market.

What Is Banking as a Service?

In a broader definition, it can be the end-to-end financial service that executes the operations over the web. But for this particular topic, we will be looking closer at those offerings that can cover the specific needs of fintech startups, such as p2p payments, direct deposit, payments, etc.

In a nutshell, BaaS is something that can be integrated into an application via API and fully cover the fintech aspect of the application features. For example, if there is a P2P payment built into the mobile application, everything related to the under the hood funds transfer is covered by the BaaS. This can be called white-labeling banking to some degree.

What Features Can BaaS Provide to a Fintech Startup?

Such services solve specific financial regulations, security, accounts, and more challenges.

Security

SSO, multi-factor authentication, and security tokens are industry standards and included in the packages of all platforms. Besides everything else, every fintech platform requires regular security checks such as penetration tests, risk assessments, vulnerability scans, data encryption, data segmentation, and external audits. All those security measures need an extensive in-house team working day-by-day, reacting to the new security threats and requirements. It is not only time-consuming but also very expensive. Choosing BaaS as a financial service means that all those actions are performed by the provider and don’t lie on the shoulders of the end client.

Compliance

Banking has always been a strictly regulated industry, and there are good reasons for that. Compliance includes a set of checks such as KYC (Know Your Client), KYB (Know Your Business), AML (Anti-money laundering), and Fraud (transaction fraud monitoring).

For example, KYC requires an extensive check of every user in compliance with the Bank Secrecy Act (BSA). It can not be skipped and can take some time very the user. Lack of experience in the fintech application team can cause delays with the verifications and, potentially, lead to cybercrime, accounts blocking, money laundering, etc. BaaS platforms provide all those tools out-of-the-box and ready to use.

Accounts

Automating regular bank account creation is not an easy task either. Background checks, tax office checks, document flow, and account numbers - are only some of the steps eliminated by utilizing third-party providers. Additionally, all accounts should be FDIC insured, which may come as a part of the package.

Debit Cards

Even debit cards can become a challenging task for those who ask how to build a fintech application. Banking as a Service will also provide an automated way to issue physical debit cards to the customers. Most of the time, fintech companies partner with the existing banks to get the cards. But this can be very time and resource-consuming simply because the paperwork can take months. This is required because only the bank can provide the app with BIN (Bank Identification Number) to the fintech.

In opposite, BaaS covers the card-issuing process and card processing which gives one more thing to care less about.

Payments and P2P payments

The Automated Clearing House (ACH) is the primary way of processing money “electronically” through the U.S banking system. Banks are well familiar with setting and processing that kind of payment. However, for a fintech startup, this means another obstacle on the way to market. Yet, this is an essential feature, especially considering how people are used to P2P money transfers. Startups typically have smaller teams and set the compliance mentioned above procedures, and ACH can be an unbearable amount of work for a new financial team.

Lending and Interest

Moreover, BaaS can offer banking products on top of regular payments and money transfers. Having the extra features on the launch is always a good thing. The majority of the platforms offer tools to collect interest on the account. Additionally, interest can be flexible and vary depending on the user’s account tier, monthly spending, etc. Since every company is created for profit, lending can be another cherry on top of the existing business models. And some of the BaaS provide this feature.

Exchange

The competition on the market is high, and users are used to the option to keep money in various currencies, including crypto. Moreover, they expect to freely exchange currencies between the accounts with one click in the app. This is the must-have feature, and Banking as a Service can allow fintech companies to operate with multiple currencies on a launch date.

What Is available on the Market?

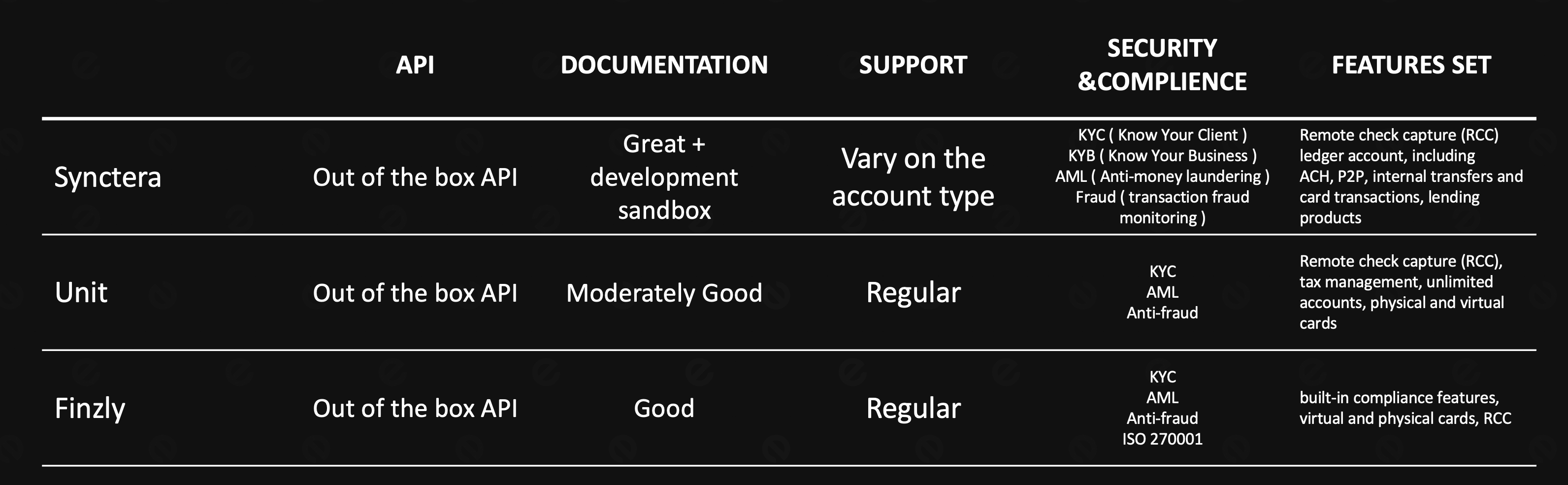

Banking as a Service is not new. It is a mature industry for providing white-labeling financial services that have existed for at least 15 years. Some “old-fashioned” banks don’t bother creating their applications and web dashboards, buying exciting solutions instead. Most internet-only banks are based on the BaaS Platforms. They offer a wide range of customizable solutions for fintech companies of every shape and size. To name a few: Unit, Finzly, Synctera. Of course, there are much more on the market. For my particular project, I have chosen Synctera because it provides better documentation and a managed server that the client owns. Of course, the choice may vary depending on the criteria. In my case - technical requirements, and another case, this might be processing fees, availability of certain features, partnership terms, and many others. All of the BaaS platforms provide custom quotes for every client, so the best way to learn about the terms is to contact them directly and talk to their representatives. Here is a short comparison of mentioned platforms I have created for my research:

On average, building a simple fintech application with payments, accounts, P2P payments, etc., can cost $300k+ and take around a year. Maintenance costs and regular security and compliance checks add extra pressure on those planning to enter the market and reach profitability as soon as possible. It is essential to report progress to investors in a startup environment regularly. Leveraging BaaS can be an attractive go-to-market strategy, effectively cutting costs and time by half.

Published at DZone with permission of Victor Osetskyi, DZone MVB. See the original article here.

Opinions expressed by DZone contributors are their own.

Comments