Using Python for Accounting And Finance Applications

Python’s development is highly robust for Finance and FinTech applications. Python is now the third most popular programming language behind C and Java.

Join the DZone community and get the full member experience.

Join For FreeThe global FinTech market was valued at $127.66 billion and is expected to reach $309.98 billion at a CAGR of 24.8%, a report by PRNewsWire suggests. The staggering growth is the result of digital payments and transactions. From investors and traders to personal loan customers, everyone is hooked to FinTech.

If you are building FinTech products to cater to this multiplying need, you are on the right track.

However, what you need is technology that can help you realize that dream. FinTech involves working with data, transaction management, scalability, APIs, and much more. Python development services are the answer to all these requirements.

Some of the already popular Python-based solutions in FinTech are Stripe, Robinhood, Zapa, Square, Paypal, amongst many others.

Python’s development is highly robust for Finance and FinTech applications. Python is now the third most popular programming language behind C and Java. It is used in Fintech because it can work efficiently with data.

In this article, we will discuss the following things:

- Why Python software development is gaining popularity.

- How is the world using Python in Finance?

- The best Python libraries for FinTech development.

- Conclusion: Why Python is best for FinTech.

After reading the article, you’ll be able to better understand why Python knowledge is so superior to other programming languages in today’s world. You’ll also learn the different Python features that make it a unique programming language for FinTech solutions.

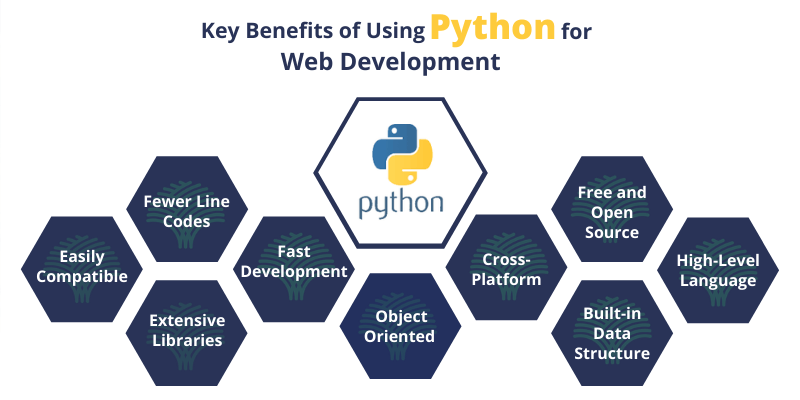

Why Python Software Development is Gaining Popularity

Apart from using Python to build payment solutions, there are multiple Python features that make it the best pick for FinTech solutions. Python in finance is the best choice due to the following reasons:

Apart from using Python to build payment solutions, there are multiple Python features that make it the best pick for FinTech solutions. Python in finance is the best choice due to the following reasons:

1. Works with Django

- Python and Django framework are made for each other. The 'batteries included' framework enables Python developers to write excellent programs. Since Fintech requires working with data, Django delivers on that promise. It offers computation capabilities, statistics, regression, analytics, and more.

2. Simple and Flexible

- The simplicity of Python-based systems is the result of a flexible and simple code. Developers can write code quickly as the syntax is not too hard.

- Financial technology services require complex features that Python engineers can easily integrate into the solution. It is also extremely flexible — allowing developers to write complicated code without any hassle.

3. Rapid MVP Development

- Python’s development is particularly helpful for rapid MVP development. Since the market is so agile, you need to be on your feet. Because of simplicity and flexibility, you can quickly build a prototype and use it to attain investment and feedback.

- Quick prototyping enables FinTech companies to gain a competitive advantage as there are more and more financial apps launched every month.

4. Highly Scalable

- Python is one of the most scalable programming languages there is. If there’s a need for an application that requires working with massive amounts of data, Python is your companion.

- There are libraries and tools for almost anything. Python developers can make quick releases even though there’s heavy traffic on the app.

5. Machine Learning Applications

- One of the most popular Python features is its applications in Machine Learning. ML and AI are data-oriented. Python data science ecosystem is unique and highly efficient. It allows writing algorithms for chatbots and smart applications with complete dynamic capabilities.

- Machine Learning capabilities help FinTech in predictive analytics while investment trading. Chatbots enable banks to better serve their customers by redirecting customer queries.

How Is the World Using Python in Finance?

Now that you know why Python is so amazing for web development let’s dive into how the industry is using it. Python is well known in the FinTech world for its robustness. Here are different areas where Python knowledge is utilized in the financial world:

Digital Wallets and Payments

Most FinTech companies use Python to build payment solutions. Digital wallets are becoming widely popular. But since they require massive transaction management and security, Python is highly preferred.

Python offers secure APIs, payment gateway integration, and scalability to manage digital wallets. The Python/Django framework is the developer’s go-to platform for building a digital wallet.

Financial Analytics

Investors and traders need to make sense of data for their financial decisions. Python software development is crucial for building analytics tools. It enables evaluating and assessing large datasets for deriving patterns and valuable information.

Scikit and PyBrain are widely known libraries that help in building applications with predictive analytics capabilities. They can carry out statistical calculations quickly with the help of algorithms built using Python development. These libraries help in developing algorithms that can predict the behaviour of any stock, investment instruments, and more. They are highly useful for banks to create models of financial performance over a period of time.

Banking Software

In recent times, banks are heavily using Python-based systems. They build their mobile banking platforms using Python in finance. Because of its scalability, flexibility, and most importantly, simplicity, Python can help banks reap the advantages of economies of scale.

Apart from that, banking networks use Python for interconnected transaction management. They are increasing their focus on building a strategy with Python.

Cryptocurrency

The latest advancements in Python are in the cryptocurrency segment. Companies dealing in cryptocurrencies require analytics and predictions for making smart decisions. The market is highly volatile. Python engineers are needed to retrieve cryptocurrency pricing and make data visualization for determining the best pricing scheme.

As the programming language evolves, more and more FinTech products in the cryptocurrency segment will emerge. The global market is slowly starting the use of crypto, which will eventually lead to higher usage of Python development services.

The Best Python Libraries for FinTech Development

Do you know what the biggest advantage of using Python-based solutions is? Developers get to use the countless libraries and tools that are available for FinTech development. These libraries mostly focus on predictive analytics, statistical calculations, payment gateway APIs, and more — the three most crucial aspects for any finance application.

Here are the best Python libraries and tools for building financial applications:

- NumPy

A standard Python library for scientific computing, allowing developers to work closely with data science and statistical computations. - Pandas

Python knowledge of pandas is essential for all developers to inculcate data manipulation capabilities in their application. - Pyalgotrade

A popular Python library for algorithmic trading. It is of high usage for predictive analytics in trading and stockbroking. - FinmarketPy

The best library for FinTech, involving the backtesting of trading strategies and analyzing financial markets. - SciPy

The most important library for scientific and technical computing allows adding ML and AI capabilities to FinTech products.

Other popular libraries for Financial products include Pyrisk, Zipline, quantecon.py, scikit-learn, pybitcointools, and many more. If you want to reap the benefits of a Fintech strategy with Python, knowing the libraries is a big advantage.

Conclusion: Why Python is Best for FinTech

Security is the major aspect of any FinTech application. The Python data science ecosystem and libraries are perfect for FinTech products.

A financial app requires the integration of various institutes, systems, and organizations. Python determines the scope of any financial product. The viability of Python software development is visible in the following Python features for fintech development:

- Python development reduces error in application development. You can easily eliminate bugs from financial apps that can threaten the transaction and payment mechanism.

- If you want more-time-to market the product, Python is an optimal programming language. You can build rapid prototypes and get a competitive edge.

- The API connections needed for the smooth functioning of any FinTech app are easily available in Python. You can build integrated apps without any hassle.

Combined with Django web development services, Python works wonders for all kinds of FinTech products. You can build feature-rich Python applications by hiring a team of Python engineers who are adept in flexible development.

Published at DZone with permission of Parth Barot. See the original article here.

Opinions expressed by DZone contributors are their own.

Comments